From Brazil to China: The Journey of Rubellite Tourmaline

March 27, 2015

Cutting in China

This video takes you through the cutting factory and headquarters of a company that fashions large quantities of tourmaline and other colored gemstones for China and the global market. You’ll also witness the creation of a faceted colored stone.

In June 2014, a member of the GIA team, Andrew Lucas, traveled to Asia to attend Gemfields’ first Mozambique ruby auction in Singapore and to teach a two-week GIA law enforcement gemology seminar in Hong Kong. While there, he visited the Hong Kong office and Shenzhen factory where Cruzeiro’s rubellite is fashioned and distributed to the market.The Miranda Group

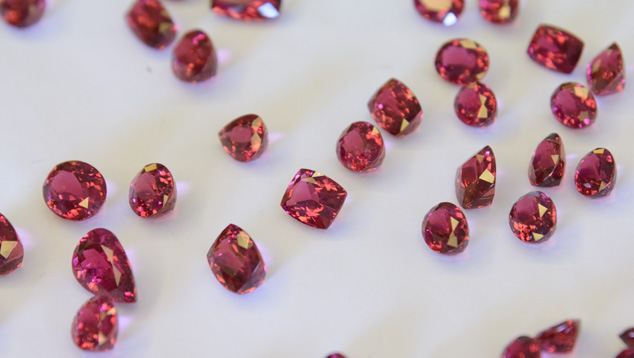

Our representative’s documentation of the journey of rubellite tourmaline from Brazil to China began at the Hong Kong office of Miranda Group Co. Ltd. There, he interviewed Miranda Costa, a co-founder of the company. They spoke in detail about his experience in the market and the connection between Brazil’s rubellite tourmaline and the Chinese market. Mr. Costa had been a partner in Miranda Gem Hong Kong between 2005 and 2009. When that company closed in 2009, Mr. Costa co-founded Miranda Group Co. Ltd.Miranda Costa of Miranda Group Co. Ltd. examines parcels of rubellite that were cut at the company’s factory in Shenzhen. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

The Miranda Group started working with rubellite in 2010 and entered into a joint venture with KGK, a global diamond, colored stone, and jewelry wholesaler, to acquire and market rubellite in China. At that time, the Miranda Group was buying rubellite from Africa. In 2011, they started working with the Cruzeiro mine and its owners, the Neves family.The Business Model

Today, the Cruzeiro mine, the Miranda Group, and KGK work together to bring Brazil’s rubellite tourmaline to the market in China. The Cruzeiro mine provides the rough rubellite to the Miranda Group, which cuts the material. The rough crystals are sliced or sawn in the Miranda Group office in Hong Kong, and then faceted and polished at the factory in Shenzhen, China. The stones then go to KGK’s factory and offices in Panyu, China.KGK markets and sells the cut stones and also mounts cut stones into jewelry for sale, primarily in China. The Cruzeiro mine also cuts its own facet-grade green and blue tourmaline in Brazil and produces bicolor and multicolor tourmaline, which the Miranda Group has been cutting and stockpiling.

Rubellite rough is sawn at Miranda Group Co. Ltd. facilities in Hong Kong before being sent to the factory in Shenzhen for preforming and faceting. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

The Miranda Group can cut about 25,000 to 30,000 carats a month at their factory in Shenzhen. They then provide the cut stones to KGK. The Miranda Group also works with bicolor tourmaline, aquamarine, morganite, emerald, and Mozambique ruby. They cut these materials and work with KGK to sell primarily to the Chinese market. They also deal in Mozambique copper-bearing tourmaline and Brazilian Paraíba tourmaline which, in cooperation with KGK, they will supply to the market in 2015.

The factory in Shenzhen was cutting tourmaline as well as morganite during the visit. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

After cutting a parcel of rubellite, the factory turned to cutting morganite, which has been growing in popularity in China. This rough morganite crystal is being sawn as part of the process. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

Interview with Miranda Costa

Fashioned Rubellite Production

The Miranda Group needs to receive 100 kilos of rough rubellite a month to meet its production goal of 25,000 to 30,000 carats. They promote more-included material for beads and carvings. The company’s goals for facet-grade material are to produce clean stones that meet the requirements of the high-end Chinese market.

Maintaining quality cutting procedures, resulting in clean stones, is of optimum concern in the factory. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

In the United States, the Miranda Group plans to market gems of three carats or smaller, to meet what they feel is the right price point for that market. In China, there is a ready market for sizes over three carats, including very large sizes of 100 carats or more.Miranda Costa estimates that the demand from the Chinese market has caused the price of rubellite tourmaline to double over the last three years. Even though there is current resistance to the high prices, the company still finds it difficult to meet the demand for fine-quality faceted stones, so he thinks there is still room for price increases.

At the Miranda Group Co. Ltd. office in Hong Kong, parcels of fine-color, clean rubellites in large sizes were being sorted for delivery to KGK. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

For high-end consumers, the rubellite needs to be well proportioned, bright, and clean, and have fine color. Because these qualities are essential, the Miranda Group only gets about 12 percent weight retention from the rough.

The faceting equipment was optimized for precision and speed. Some machines use a two-wheel set-up that cuts the facets and then polishes them without a need for stopping and changing wheels. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

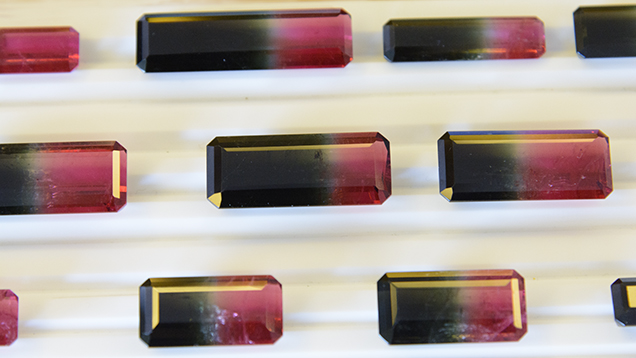

Since many of the crystals from the Cruzeiro mine are bicolor or multicolored, the Miranda Group also cuts that material. Many of the tourmaline crystals from Cruzeiro are zoned with black, green, and rubellite colors. The Miranda Group has been cutting and accumulating green-and-rubellite material over the last two years, so they have about 80,000 to 100,000 carats in stock now. They plan on marketing it in the US and China in the near future.

The Miranda Group obtains green-and-rubellite bicolor tourmaline rough for cutting. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

The Miranda Group is stockpiling inventory to launch a marketing campaign with KGK for bicolor tourmaline. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

Comparing Brazilian rubellite tourmaline rough to the material Miranda Costa used to get from Nigeria, he finds the Cruzeiro material to be cleaner, with better crystallization and more even color. Mr. Costa sees much less Nigerian material on the market today, and the prices are much higher than when the company was buying large quantities in 2010.

Brazilian rough can yield fine-color, clean, bright, and good-sized stones. However, to meet those standards, the weight loss is high, saving only an average of 12 percent of the rough weight. Photo by Andrew Lucas/GIA, courtesy Miranda Group Co. Ltd.

Completing the Journey

Visiting a mining operation and witnessing the challenges involved in bringing colored gemstones out of the earth gives you a sense of perspective on how rare and valuable they really are. It’s exhilarating to observe the production at a prolific mine like the Cruzeiro, where impressive crystals come right out of the ground in large quantities. It’s also satisfying to complete the journey by seeing the rough crystals turned into beautiful faceted stones. Finally, seeing the ferocious and increasing appetite of a consuming country for the material puts the relationship between supply and demand perfectly in perspective.

About the Author

Andrew Lucas is manager of field gemology at GIA in Carlsbad, California.

DISCLAIMER

GIA staff often visit mines, manufacturers, retailers and others in the gem and jewelry industry for research purposes and to gain insight into the marketplace. GIA appreciates the access and information provided during these visits. These visits and any resulting articles or publications should not be taken or used as an endorsement.

Acknowledgments

The author thanks Miranda Group Co. Ltd., the Cruzeiro mine, and Nevestones.